MSCI Q1 2025: Resilience, Growth, and Positioning for a Volatile Market

MSCI Q125 Business Update

“We provide mission-critical data, models, and technology that clients need in all environments and all phases of the business cycle, but especially in periods of high uncertainty, low clarity and relative volatility in markets. This enables MSCI's all-weather franchise, robust cash flows and fortress balance sheet and all of that makes us confident in our ability to deliver consistent financial results amidst the current market turmoil.” MSCI CEO Henry Fernandez Q125 conference call

MSCI recently reported Q125 earnings earlier this week. Below are my takeaways from MSCI’s latest quarter.

Table of Contents:

Financial & Operating Performance

Client Segment Performance

Product Line Insights

Strategic Partnerships

Business Resiliency & Market Position

Market Environment & Outlook

Retention & Pricing Power

Financial Results

Summary

1. Financial & Operating Performance

Durable Retention & Revenue Growth

Strong retention rates across client segments.

Asset-based fee revenue growth (+18%).

New recurring subscription sales are down vs. Q1 2024.

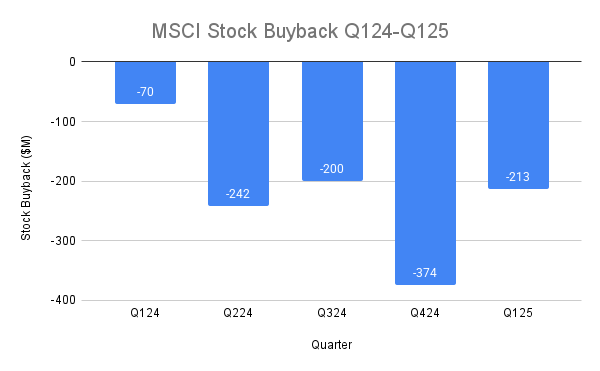

Share Buybacks

Ongoing repurchases reflect confidence in stock value and capital allocation discipline.

MSCI currently has $1.3B left in its share-repurchase program

Expense Management

In times of market slowdowns, MSCI can pull 3 levers to minimize costs: 1) flexing hiring pace, 2) professional fees, and 3) incentive comp.

Each can represent a ~$20M annual impact per expense lever.

2. Client Segment Performance

Hedge Funds: +14% subscription run rate growth.

Next-gen factor models adopted by 60+ hedge funds (up from 8 in 2022).

Banks & Broker Dealers: +9% growth.

Wealth Managers: +15% growth.

Major multi-location renewal deal with a global institution (+38% run rate expansion).

Displaced the equity benchmarks of two key competitors

Direct indexing AUM +30% to $131B.

Asset Owners: +12% growth.

Asset Managers: Steady ~5% growth.

Retention rate improved to 96%.

3. Product Line Insights

Index Solutions

Overall subscription run rate growth: +9%.

Double-digit subscription run rate growth for hedge funds (22%), wealth managers (16%), and banks and broker-dealers (11%)

Subscription run rate growth for Custom Indexes: +15%.

Asset-Based Fee Revenue: +18% driven by strong flows to international products

Non-ETF AUM: $3.9T (+20% y/y).

MSCI-linked equity ETFs: $1.78T.

Saw the highest cash inflows since 2021

Fixed Income ETF AUM: $76B (+20%).

Climate & Sustainability

Retention rate: 94.5%.

Geographic growth: EMEA +14%, Americas +4%, APAC +8.5%.

Demand muted in U.S.; regulatory complexity in Europe.

ESG shifting from ratings to deeper data transparency.

Private Capital Solutions

+24% recurring net new sales.

Mid-teens run rate growth.

Focus on Institutional LPs, Wealth LPs, and GPs.

Real Assets

Activity muted due to client consolidation in brokers and developers.

Retention Rates

Overall, clients are using MSCI’s products more than last year

4. Strategic Partnerships

Moody’s Partnership: 1+1=3

Joint development of private credit risk assessments.

Leverages Moody’s credit models and MSCI’s private credit data.

Cross-marketing across both client bases.

“We have gone to the senior management of Moody's and said to them we have a number of highly complementary capabilities. On the success of that working relationship and partnership, we started talking about what are all the other things that we can do that one plus one is three so that they don't have to replicate what we do and we don't replicate what we do.” - MSCI CEO Henry Fernandez

5. Business Resiliency & Market Position

98% recurring revenue.

High margins and strong cash flow conversion.

MSCI is a mission-critical provider during volatility.

Clients increasingly rely on stress testing, analytics, and transparency tools.

“Our global frameworks must have content and trusted risk and performance tools are essential for understanding and navigating markets. And our relationships with the world's leading investment institutions are deeper than ever, positioning us to help them navigate global markets. With 98% recurring revenue, strong margins, and high cash flow conversion, we have a highly resilient financial model that positions us for strength in all environments.” - MSCI CFO Andy Wiechmann Q125 conference call

6. Market Environment & Outlook

Positive Tailwinds

Low interest rates & weak dollar are driving flows into non-U.S. markets.

Increased client need for data amid volatility.

Long-term secular growth opportunities intact.

MSCI Index and Analytics segments should see a strong benefit from these tailwinds.

Challenges

ESG is facing cyclical headwinds.

“The old ESG is on a cyclical headwind. We continue to believe that, on a secular structural basis, factors related to sustainability and understanding the inside of portfolios will be positive and will return to higher growth. But the demand is also changing.” - MSCI CEO Henry Fernandez

Muted climate demand, especially in the U.S.

“Clients are committed to sustainability, and climate is very topical and a big focus area for them. We are seeing muted demand in areas. Needless to say, it's a very nuanced and dynamic landscape. But, we are seeing subdued demand, particularly in the U.S., where investors remain cautious about launching sustainability strategies and funds… And, even in Europe, we've seen some regulatory complexity.” - MSCI CEO Henry Fernandez

Client Behavior

No significant change in purchasing habits.

“As of today, we don't have evidence that there is a change in the purchasing habits or the pipeline with our clients… we believe that some of those items that didn't close in Q1 will close in Q2.” - MSCI COO Baer Pettit

High engagement levels, particularly outside the U.S.

Growth Drivers

3 Forces: 2 positives, 1 negative

Rising client demand for data & analytics.

Asset reallocation to non-U.S. markets.

Client budget constraints (the main negative force).

7. Retention & Pricing Power

Lower cancellations y/y, especially with hedge funds and banks.

Index: -44%

Analytics: -26%

Climate: -36%

Consolidated: -30%

“If we look at Q1 of this year, compared to Q1 of last year, we had lower cancels across most client segments, and we had notable declines in cancels with hedge funds and banks compared to a year ago.” -MSCI COO Baer Pettit

Cancellations are mainly due to client events, not pricing—indicating pricing power. This also highlights MSCI’s consumer surplus building with clients.

“There are definitely areas where we could push price more, but we are very focused on being a very strong partner to our clients as we said before.” -MSCI CFO Andy Wiechmann

8. Financial Results

MSCI grew revenues ~10% y/y to $746 million. Recurring subscription revenues grew 7.7%, and asset-based fees jumped to 18%.

Gross Margins: 81.7% (+60bps y/y)

Operating Margin: 50.6% (+50bps y/y)

Share Count: 77.8M (-2.1% of shares were bought back y/y)

EPS: $3.71 (+15% y/y)

FCF: $269M (-2.5% y/y)

FCFPS: $3.46 (flat y/y)

FCF Margin: 36% (-400 bps y/y).

Debt to FCF: 3.2x

Interest Coverage Ratio: 8.6x

Valuation: 3% FCF yield, above its historical average of 2.6%, meaning that MSCI is around fair value with some room for multiple expansion

Summary

MSCI’s Q1 2025 highlights the company’s strong resilience and continued growth across key client segments despite a softer environment for new sales. With 98% recurring revenue, high retention rates, and robust demand for its data, analytics, and index solutions, MSCI remains a critical partner during market volatility. The company is benefiting from global investment flows, a weaker dollar, and sustained interest in private capital and custom indexes, while navigating cyclical headwinds in ESG and climate demand. Strategic partnerships, like the one with Moody’s, and flexible cost management reinforce MSCI’s confidence in its long-term growth outlook. In recent months, I have been adding to my position in MSCI, especially in this volatile market, and after these results, I will continue to add to my position (see me latest portfolio update here).

Thank you for reading. If you enjoyed reading it as much as I enjoyed putting it together, feel free to subscribe to the Invested Capital Newsletter and share this with a fellow investor! I hope you have a great rest of your day.

Happy Compounding

Matt Harbaugh