Howard Marks: The Calculus of Value

How to judge fundamentals and stay rational when markets lose their mind

Welcome to issue #008 of Invested Capital. Each week, I share one letter/interview to help you invest smarter, think long-term, and build lasting wealth. My goal? To cut through the noise and bring you timeless lessons from great investors so you can make better decisions with your money and your life. Join 508+ readers learning how to compound capital and wisdom, one issue at a time.

In this week’s issue, I’m sharing my highlights and takeaways from Howard Mark’s letter, The Calculus of Value

Value is derived from fundamentals

“The value of an asset is derived from its ‘fundamentals.’ The fundamentals of a company, These include its current earnings, its earning power in the future, the steadiness or variability of its future earnings, the market value of its component assets, the skill of management, its potential to develop new products, the competitive landscape, the strength of its balance sheet, and the myriad additional factors that will influence the company’s future.” - Howard Marks

8 factors that comprise a company’s fundamentals according to Marks:

Current earnings

Future earning power

Steadiness/variability of its future earnings (ie. predictability/cyclicality)

Market value of assets

Skill of management

Potential to develop new products

Competition

Balance sheet strength

The role of management

“Combining individual assets to maximize a company’s overall earning power is the top job of management. When successful, the result is synergy: the benefit gained from skillfully combining things.” - Howard Marks

The job of management is to maximize the effective use of its assets (both tangible and intangible) to improve earnings power.

When management has aligned incentives with investors, they are able to effectively build a business for the long term and improve earnings power in the future.

If it doesn’t produce cash, you can’t value it objectively: Focus on assets that have cash flow

“I think of assets that don’t produce operating cash flow or have the potential to do so in the future as not having earning power, and that makes them impossible to value objectively, analytically, or intrinsically” - Howard Marks

For assets that don’t produce cash flow, you can’t accurately estimate the intrinsic value.

If it doesn’t produce cash flow, you are playing the Greater Fool Theory, in which you hope another fool will pay a higher price for your asset in the future.

That is a game you don’t want to play. Instead, focus on businesses with cash flow.

Long-term performance is dependent on your ability to accurately judge a business’s earning power and pay a fair price for it

“An investor’s ability to earn an attractive return on an investment will largely depend on whether he accurately appraised the investment’s fundamentals and paid an appropriate price for those fundamentals. In the long term, the success of an investment will hinge primarily on whether the buyer was right about the asset’s earning power.” - Howard Marks

As an investor, you are judged on how good you are based on returns on capital, which all comes down to how good your judgment is in determining intrinsic value and paying a fair price for that asset.

The better your judgment, the higher returns you earn.

Price is the consensus view of value

“But in the real world, price is set by a different discounting process, which consists mostly of people applying their subjective opinions and attitudes about what the asset and its earning power are worth. So that’s what an asset’s price is: the consensus view of investors regarding its underlying fundamental value.” - Howard Marks

The stock price is simply the consensus view of what the market believes the underlying fundamental value is at that time.

However, as Marks explains in this letter, price alone doesn’t tell the whole story.

“The price of an asset means nothing in isolation. You can’t tell whether a car is good buy at $40,000 unless you know about the things that determine its market value.”

Markets are a voting machine

“According to Benjamin Graham, the father of value investing and Warren Buffett’s teacher at Columbia, market prices are set each day by investors who cast their votes by offering to buy or sell. Some investors think a company has a solid product line and competent management, and others consider it stodgy and outmoded. Some investors find another company sexy and right for the future, and others think it’s a risky high-flyer. These attitudes are converted into asset prices.” - Howard Marks

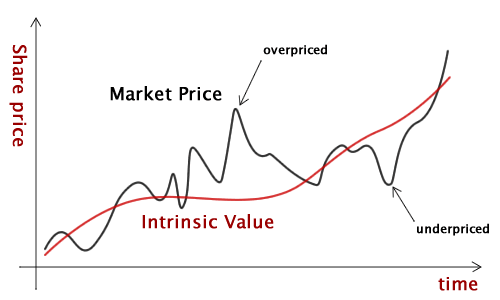

Markets are a voting machine in the short-term and a weighing machine in the long-term. Stock prices are votes on the perception of intrinsic value. When optimism dominates, price runs ahead of fundamentals. When fear takes over, the price falls below.

Magnetic value

“Value should be thought of as exerting a “magnetic” influence on price. If price is above value, future price movements are more likely to be downward than upward. And if price is below value, future price movements are more likely to be upward than downward.” - Howard Marks

Peter Lynch famously said, “If you can follow only one bit of data, follow the earnings, assuming the company in question has earnings. Eventually, earnings will find their way into the stock price”.

Price can remain irrational longer than you can remain solvent

“An undervalued asset can remain cheap – or even get cheaper – for a long time, just as an overvalued asset can become more overvalued, and then extremely overvalued, and then crazily overvalued. It’s the ability of price to go to crazy extremes that causes bubbles and crashes. John Maynard Keynes said, “The market can remain irrational longer than you can remain solvent.” It’s intellectually sound to expect price to move toward value rather than diverge further from it, and even to bet that it will happen, but it’s unwise and potentially dangerous to bet heavily that it’ll happen soon.” - Howard Marks

You can’t predict short-term price movements. If you believe the market is in a bubble, the bubble may not burst for many more years than you think. Markets are made up of people, and people are inherently irrational.

Sentiment dictates price

“When the majority of investors are optimistic, they cause price to rise and potentially exceed value. And when the pessimists reign, they cause price to decline and potentially fall short of value.” - Howard Marks

When a stock reaches an all-time high, investors are overwhelmingly optimistic on the business, citing higher growth rates and pushing up multiples.

On the other hand, when the stock price is reaching new lows, investors think it’s the end of the world of the business, compressing multiples.

Sentiment dictates price, and your job as an investor is to judge whether or not that price is fair, regardless of sentiment

Watch for changes in investor psychology

“A preponderance of investor psychology on one side or the other can create the bargains or over-pricings the hypothesis says can’t exist. Investors should be on the lookout for them.” - Howard Marks

When sentiment pushes a stock price to extremes, you should look more into the names that are “bargains” (poor sentiment) and watch out for “over-pricings” (rich sentiment).

Price is what you pay, value is what you get

“Value is what you get when you make an investment, and price is what you pay for it. A good investment is one in which the price is right for what the value turns out to be. Due to the volatile nature of investor psychology, asset prices fluctuate much more than fundamental value. Most price changes reflect changes in investor psychology rather than changes in fundamental value. Because of the key role psychology plays in setting asset prices, in order to have a sense for where price stands relative to value, investors should try to gauge prevailing psychology, not just quantitative valuation parameters. The relationship of price to value should be expected to strongly influence investment performance, with high valuations presaging low subsequent returns, and vice versa. But that relationship must not be counted on to have the expected impact in anything but a long-term sense.” - Howard Marks

Don’t just rely on numbers; you need to see what investor psychology is in terms of pricing. Those who understand investor psychology and its relationship between price and value will earn superior returns.

Anticipate changes in price and value to earn superior returns

“It’s helpful to think of returns as stemming from (a) changes in value and (b) changes in the relationship between price and value, and the people who earn superior returns are the ones who anticipate those changes better than others.” - Howard Marks

4 conditions for superior risk-adjusted returns

The consensus of investors doesn’t fully comprehend the asset’s current value.

The market price is too low for the current value of the asset.

The asset’s value increases more than investors anticipated, usually because of an unforeseen increase in its earning power.

The asset becomes more popular with investors, resulting in an increase in its price that is unrelated to changes in value.

Don’t oversimplify

“Basing an investment decision on a single metric, such as a stock’s p/e ratio, represents a vast oversimplification of the decision, and thus introduces the possibility of error.” - Howard Marks

Don’t oversimplify your investment decision-making on a single metric.

Valuation is never one number, it’s a distribution of outcomes.

7 indicators of investor behavior to watch for market bubbles

Elevated S&P 500 P/E

Elevated S&P 500 P/S

Barclays’ “equity-euphoria indicator” that measures derivative flows

Warren Buffett indicator (aggregate market cap of U.S. stocks to U.S. GDP)

10-year Treasury yield and S&P 500 dividend yield

Meme stocks (high retail investor involvement)

Yield spreads on corporate debt compared to treasuries

Understand the other side

“If you’re not conversant with the arguments of those who oppose your position, you really can’t assess its validity” - Howard Marks

Charlie Munger once said, “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

Before you buy, study the bear case. Before you sell, understand the bull case. It’s the difference between reacting to markets and thinking independently.

The INVESTICON framework: Managing risk in euphoria

“I consider tactical actions in terms of the spectrum that runs from aggressiveness to defensiveness, and when valuations are high, I consider becoming more defensive.” - Howard Marks

Howard Marks believes that an investor should have a spectrum of “readiness” when it comes to market valuations.

Similar to the military’s idea of DEFCON 1, as in full alert of a nuclear attack, the INVESTICON framework provides an investor with a series of actions while in market euphoria. Marks’s INVESTICON framework is as follows:

6. Stop buying

5. Reduce aggressive holdings and increase defensive holdings

4. Sell off the remaining aggressive holdings

3. Trim defensive holdings as well

2. Eliminate all holdings

1. Go short

With INVESTICON 1 being the most extreme scenario of fully going short and INVESTICON 6 being the least extreme.

While he thinks markets are extended in terms of valuations, Marks believes that investors should be in INVESTICON 5: reducing aggressive holdings and increasing defensive holdings.

When markets are at extremes, have a system to manage capital allocation.

Closing thoughts

The calculus of value is simple:

Judge fundamentals.

Stay patient.

Let sentiment come back to you.

Tl;dr

Value is derived from fundamentals

Management’s job is to maximize earnings power

Your performance is dictated by how well you judge intrinsic value

Sentiment dictates price; watch out for changes in investor psychology

Stocks have a magnetic value that pulls stock prices in the long term

Anticipate changes in investor sentiment to earn superior returns

Understand the other side’s argument

Use the INVESTICON framework during market euphoria

If you enjoyed reading this, the best compliment I could receive would be if you shared it with one person or restacked it

Thanks for reading

Happy Compounding

Matt Harbaugh

Follow me on Twitter/X

Source: