Inside Michael Mauboussin’s ROIC Framework (Every Investor Should Know)

What most investors misunderstand about ROIC and growth

Welcome to issue #010 of Invested Capital. Each week, I share one letter to help you invest smarter, think long-term, and build lasting wealth. My goal? To cut through the noise and bring you timeless lessons from great investors so you can make better decisions with your money and your life. Join 570+ readers learning how to compound capital and wisdom, one issue at a time.

Every investor eventually reaches the same realization: not all growth creates value. Some companies grow revenue aggressively but destroy value behind the scenes because it costs them more than a dollar to generate a dollar of incremental profit.

That’s why this week’s issue breaks down one of Michael Mauboussin’s most important pieces ever written — Return on Invested Capital: How to Calculate ROIC and Handle Common Issues (2022).

By the end of this newsletter, you’ll understand:

What ROIC really measures,

How to calculate it accurately,

The biggest pitfalls investors make,

Why regression to the mean matters,

and how ROIC connects directly to long-term value creation.

Let’s dive in.

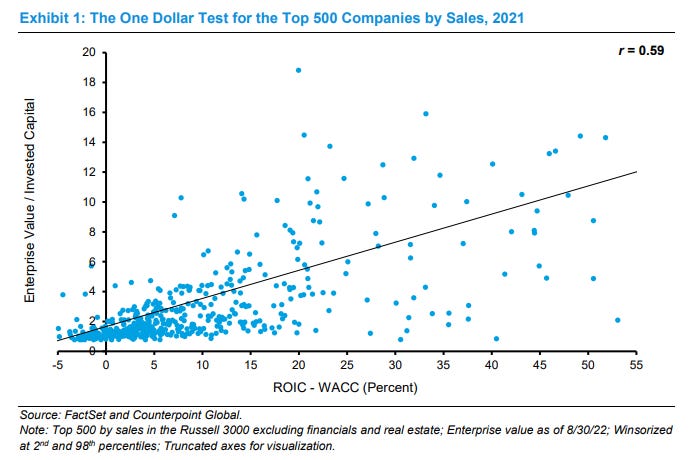

The One Dollar Test

“A company creates value when one dollar invested in the business is worth more than one dollar in the market. This happens when the firm is able to make investments that generate a return above the opportunity cost of capital. Companies pursue strategies, often related to differentiation or cost leadership, that allow them to create value over time.” -Michael Mauboussin

You want to find companies that are able to generate more money than they invest in the business.

To do this, run the One Dollar Test.

ROIC-WACC= Value Creation

If positive, then that shows that the business can generate a return above the opportunity cost of capital. (20% ROIC - 10% WACC = +10% value creation)

If negative, then the business’s opportunity cost of capital outweighs its returns and thus should be avoided. (5% ROIC - 10% WACC = -5% value creation)

A company creates value when one dollar invested in the business is worth more than one dollar in the market. This happens when the firm is able to make investments that generate a return above the opportunity cost of capital. Companies pursue strategies, often related to differentiation or cost leadership, that allow them to create value over time.

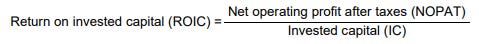

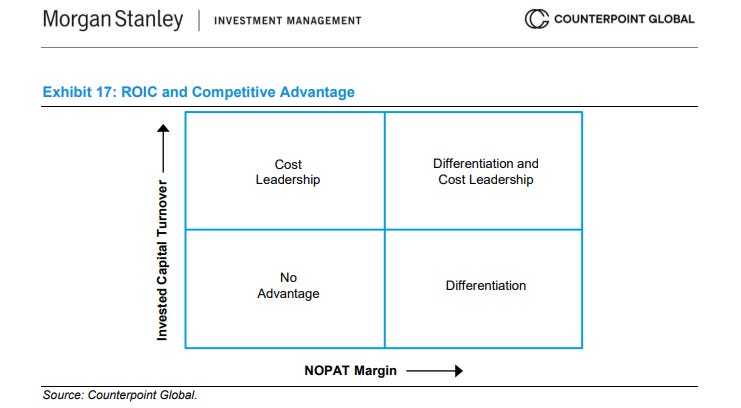

2 Ways to Calculate ROIC

“You can think of invested capital, the denominator of the ROIC calculation, in two ways that are equivalent. The first is the net assets a company needs to generate NOPAT. The second is how the company finances those net assets, typically through a combination of debt and equity.” -Michael Mauboussin

Return on invested capital (ROIC) is a measure of value creation.

The metric is simple in principle.

The numerator, net operating profit after taxes (NOPAT), is the cash earnings of a business excluding any financing costs.

That means that NOPAT is the same no matter how the company chooses to finance itself.

The denominator, invested capital, is equivalently the net assets a company needs to run its business (operating) and how it finances those assets (financing).

Because balance sheets balance, these approaches are equivalent.

However, if you do the financing approach using the balance sheet (debt & equity), it can be misleading, whereas the operating approach gives you a clear sense of the assets the company is deploying and allows you to track changes in asset efficiency over time.

If deciding between the two, Michael Mauboussin recommends the operating approach

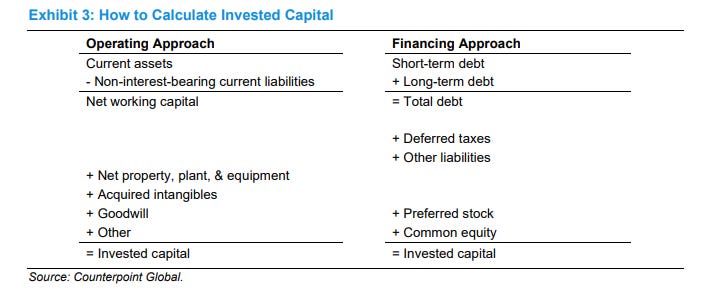

ROIC Reverts to the Mean

“Historical results show that ROIC tends to regress toward the mean. Regression toward the mean says that outcomes that are far from average are followed by outcomes with expected values closer to the average.” -Michael Mauboussin

ROIC is a snapshot in time.

Some businesses start with high ROICs and get even better.

Others have low ROICs that don’t improve.

What investors should care about is how ROIC will change over time.

What you can do is measure return on incremental invested capital (ROIIC).

ROIIC captures the relationship between the change in NOPAT and the change in invested capital

Companies that earn high ROIICs are usually capital efficient or have substantial operating leverage.

But regression is powerful.

That implies that extreme good or bad outcomes will be followed by outcomes with an expected value closer to the average.

Investors should always keep both ideas in mind.

Look for increasing returns while understanding that achieving and sustaining high returns is rare.

How ROIC is Linked to Growth

“The level of ROIC is the maximum supportable growth rate of the business excluding external financing.” -Michael Mauboussin

This is based on the following formula: Growth = ROIC x (1 – payout ratio).

The payout ratio is the proportion of NOPAT a company pays out to its shareholders in the form of dividends and buybacks.

Money paid out to shareholders leaves less to invest in the business.

Research shows that those companies that sustained high ROICs and high sales growth generated much higher total shareholder returns than companies with low returns and growth

2 Schools of Thought on Cash (be in the second camp)

One of the challenges in calculating ROIC is the level of cash a business has.

Excess cash (cash not needed to operate the business) holds an option value.

What that means is they have the right but not the obligation to make an investment.

Companies that have a surplus of cash are in a great position to pounce when attractive internal/external investment opportunities come up.

However, this is where management plays a big role and is why you want to choose management with integrity and talent.

You see, the market values the cash of firms with good investment opportunities at a premium (ie. Berkshire Hathaway), and at a discount with firms that have poor corporate governance.

School 1: Executives are stewards of capital

The first argues that executives serve as the stewards of capital and hence should have their feet held to the fire to deliver returns above the cost of capital on all of the company’s capital. This approach gives no pass to those companies with poor governance or poor incentives. This boils down to an issue of capital allocation. Executives should make sure that all assets are delivering value if their prime responsibility is the judicious allocation of capital.

School 2: ROIC and capital allocation are separate issues

The second school believes that investors should address the ROIC calculation and capital allocation issues distinctly. The ROIC calculation is meant to provide insight into how efficiently a company uses its operating capital. An assessment of management’s capital allocation skills focuses on how the company allocates its resources and what the prospective returns from those actions may look like.

Michael Mauboussin recommends that you be in the second camp.

You do that by stripping out cash to truly understand the underlying economics of the business.

Industry Matters

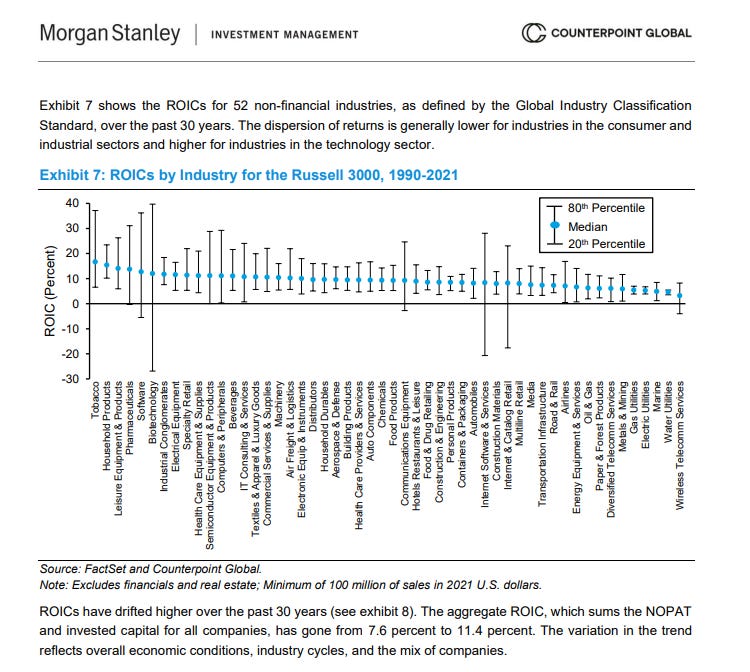

“A company’s ROIC is determined in part by the industry it competes in and the strategies it pursues.” -Michael Mauboussin

The dispersion of returns is generally lower for industries in the consumer and industrial sectors and higher for industries in the technology sector.

ROIC and Competitive Strategy Analysis

“An ROIC in excess of the cost of capital reflects competitive success that is the result of a strategy. Understanding how a company achieves its returns can provide guidance in assessing whether they will be sustainable.” -Michael Mauboussin

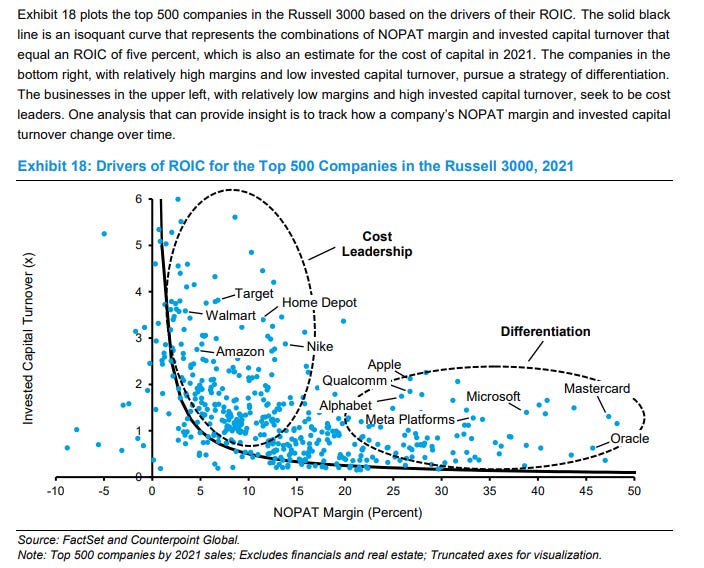

There are 2 strategies to gain an advantage

Differentiation: differentiation means that a company can price its good or service at a premium to others.

Cost Leadership: cost leadership means a company can deliver its offering at a relatively low price.

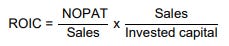

ROIC can be broken down into a measure of margins, or profitability per unit (NOPAT/Sales), and capital efficiency (Sales/Invested capital).

If a business gets to a high ROIC through a high NOPAT margin, you should focus your analysis on differentiation.

If the company’s high return comes from a high invested capital turnover ratio, emphasize analysis of cost leadership.

Rare companies have high NOPAT margins and high invested capital turnover ratios. Generally, those companies have advantages reinforced by economies of scale.

The companies in the bottom right, with relatively high margins and low invested capital turnover, pursue a strategy of differentiation. (Think Microsoft, Oracle, Meta, Mastercard, and Google)

The businesses in the upper left, with relatively low margins and high invested capital turnover, seek to be cost leaders. (Think Walmart, Amazon, and Home Depot)

Limits of the ROIC

“Estimating ROIC is conceptually straightforward but there are a number of practical matters to consider when doing the calculation.” -Michael Mauboussin

ROIC has limitations.

For example, the calculation needs to be modified for companies in the financial sector.

ROIC is also a poor way to assess M&A deals because the cost (invested capital) is reflected immediately and the benefit (NOPAT) comes over time.

Most deals, even those that create substantial value for the buyer, look poor when viewed through this lens.

The right way to assess an M&A deal is to do a net present value calculation.

(There is research that shows that companies that have high ROICs are, on average, better at doing good M&A deals than those that have low ROICs. This suggests that capital allocation skills apply both internally and externally).

But perhaps the biggest challenge is that ROIC can be calculated many different ways.

Two major adjustments are subtracting goodwill and intangible assets that arise from acquisitions, and the capitalization of intangible investments.

At the end of the day, the approach you use to calculate ROIC should try to answer the question you are asking about the business

Tl;dr

A company creates value when one dollar invested in the business is worth more than one dollar in the market.

Use the operating approach to get a clear sense of ROIC.

Regression to the mean is powerful, those that sustain high ROIC are rare.

Address the ROIC calculation and capital allocation issues distinctly.

A company’s ROIC is determined in part by the industry it competes in.

Know which strategic lever drives returns: margins or turnover.

ROIC has limits: adjust for M&A and intangibles.

If you enjoyed reading this, the best compliment I could receive would be if you shared it with one person or restacked it

Thanks for reading

Happy Compounding

Matt Harbaugh

Follow me on Twitter/X

Source:

Michael Mauboussin Return on Invested Capital: How to Calculate ROIC and Handle Common Issues (2022)

This is gold — understanding ROIC teaches you how money works in businesses, but investing in yourself teaches you how money works in life. Skills, habits, and courage compound faster than capital. Start now, and your future self will thank you.

This is a clear and useful breakdown of the ROIC framework—especially the distinction between operating assets and financing. The operating approach you highlight gets to the heart of capital efficiency, which is often dictated by day-to-day financial workflows. While ROIC measures the outcome, TCLM explores the operational inputs: how systems for managing trade credit, collections, and payment terms directly impact that invested capital turnover ratio. A helpful lens for connecting financial results to process.

(It’s free)- https://tradecredit.substack.com/